Apeiron is an independent real asset investment and asset management firm with clients at the centre of everything that we do. We provide innovative, unconflicted strategic advice to a diverse client base of Sovereign Wealth Funds, Institutional Investors and Family Offices. Our value proposition depends on investment experience, open architecture and unbiased advice. We pride ourselves on always being on the same side of the table as our clients.

Approach

Long-term, Responsible and Sustainable Approach to Ownership

Apeiron is committed to meeting our investment partners’ financial objectives whilst simultaneously ensuring sound ethical behaviour and integrity.

We are committed to promote and incorporate good governance standards in our decision making processes and day-to-day business running by creating a resilient and sustainable business in which our stakeholders can have confidence and trust.

Apeiron operates as an owner with a long-term perspective and takes into account environmental, social and governance issues when making business and investment decisions.

Investment Strategy

Apeiron delivers a comprehensive range of investment strategies and can tailor investment to meet specific needs of partners or vendors and invest in direct assets and portfolios across the capital structure.

We are seeking real asset related investment opportunities in the UK and Germany that offer the ability to accomplish a risk and reward balance in the capital structure and value creation potential through strategic and operational improvement.

Asset Management

Our asset management proposition relies on investment expertise, an integrated approach between portfolio management and execution as well as institutional quality client servicing. We look to create value by identifying attractive opportunities in niche real asset segments combined with a disciplined asset management approach.

At Apeiron, we employ a thorough and conservative underwriting approach centred upon achieving our targeted returns while limiting downside risk to the extent possible. Our approach is focuses on fundamentals such as enhancement of environmental performance, adding net lettable space, planning upside and change of use.

Views

News

CONTACT

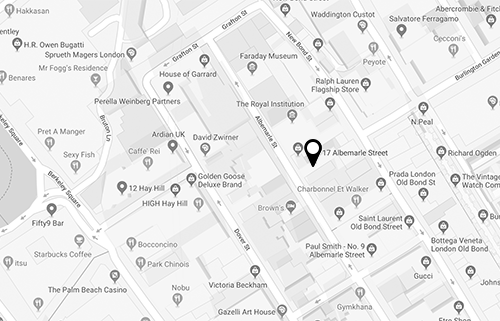

LONDON: Apeiron Capital Limited